It’s a strange feeling to watch the beginning of the carnage in the housing market and know that it must get much worse if my sons are to have a chance to buy a home for a price they can afford.

Here are my posts for the past two weeks:

The Inevitable Masquerading as the Unexpected

Inflation Porn

Here are some short takes and some weekend reading:

Doug Hoyes explains why he does “not expect a significant rise in homeowner insolvencies until mid- to late-2023.”

A judge has ruled against CRA in three appeals of gross negligence penalties, not based on the merits of the cases, but because of CRA’s “egregious” behaviour. From the judge’s ruling, it seems that CRA is willing to flagrantly violate court rules in cases where they believe taxpayers are guilty of gross negligence. A powerful government agency such as CRA has no business engaging in such gamesmanship. If CRA is correct about the conduct of these taxpayers, they should follow court rules and argue the merits of the cases. Canadians are justified in being upset with CRA not only for flouting court rules, but also for letting allegedly cheating taxpayers off the hook.

Chris Mamula gives an interesting account of the Bogleheads conference. Apparently, they don’t think much of ESG investing. I agree.

Kerry Taylor and Dan Ariely have some interesting advice on how to survive a market crash.

Friday, October 21, 2022

Short Takes: Homeowner Insolvencies, CRA Flouting Court Rules, and more

Wednesday, October 19, 2022

Inflation Porn

We’ve certainly heard a lot about inflation in the past year or so. Despite the Bank of Canada’s efforts to fight inflation by raising interest rates sharply, we still see headlines blaring that inflation is very high. What’s behind all this?

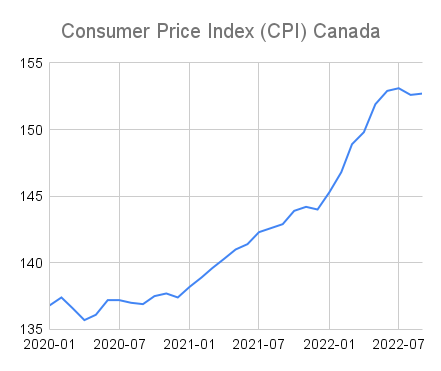

Here is a chart showing the official Consumer Price Index (CPI) for Canada since 2020.

We see that inflation was low in 2020, prices rose sharply during 2021 and the first half of 2022, and prices have actually dropped slightly in the past 3 months. However, this is at odds with headlines still screaming that September inflation was still very high at 6.9%. What gives?

The answer is that we often measure inflation by comparing current prices (as measured by CPI) to what they were a year ago. So, headlines about September inflation are measuring the change from September 2021 to September 2022. Last month’s headlines focused on August 2021 to August 2022. If it seems like the news is churning out stories with 12-month figures where 11 of those months are old news, that’s because you’re paying attention.

The inflation we saw for about 18 months was very real, and it hurts people on fixed incomes. Even though inflation has paused for 3 months, the percentages in the headlines were inflation at 7.6%, 7.0%, and 6.9%. Even if prices stay flat in October, next month’s headlines will say inflation is still high. Apparently, scary headlines are preferable to the news that prices seem to be stabilizing. I guess frightened readers keep reading.

Does this mean our inflation problems are over? I have no idea. We’ll see what the Bank of Canada thinks when they make their interest rate announcement next week. It could be that they hope to drive prices back down somewhat to erase the recent high inflation. But that’s just speculation. What I know for certain is that scary inflation headlines will keep coming for a while, whether they make sense or not.

Monday, October 10, 2022

The Inevitable Masquerading as the Unexpected

Rising interest rates are causing a lot of unhappiness among bond investors, heavily-indebted homeowners, real estate agents, and others who make their livings from home sales. The exact nature of what is happening now was unpredictable, but the fact that interest rates would eventually rise was inevitable.

Long-Term Bonds

On the bond investing side, I was disappointed that so few prominent financial advisors saw the danger in long-term bonds back in 2020. If all you do is follow historical bond returns, then the recent crash in long-term bonds looks like a black swan, a nasty surprise. However, when 30-year Canadian government bond yields got down to 1.2%, it was obvious that they were a terrible investment if held to maturity. This made it inevitable that whoever was holding these hot potatoes when interest rates rose would get burned. Owning long-term bonds at that time was crazy.

One might ask whether we could say the same thing about holding stocks in 2020 when interest rates were so low. The answer is no. Bond returns are very different from stock returns in terms of unpredictability. We use bond prices to calculate bond yields; one is completely determined by the other. The situation is very different with stocks. Even when conditions don’t look good for stocks, they may still give better returns than the interest you’d get if you sold them to hold cash. All the evidence says that most investors are better off not trying to time the stock market.

Most of the time, investors are better off not trying to time the bond market either. However, the conditions in 2020 were extraordinary. Long-term bonds were guaranteed to give unacceptably low returns if held to maturity. This was a perfectly sensible time to shift long-term bonds to short-term bonds or cash savings.

Houses

The only way house prices could rise to the crazy heights they reached was with interest rates so low that mortgage payments remained barely affordable. Fortunately, the government imposed a stress test that forced buyers to qualify for a mortgage based on payments higher than their actual payments. This reduced the damage we’re starting to see now. Unfortunately, there is evidence that some homeowners faked their income (with industry help) so they could qualify for a mortgage. This offset some of the good the stress test did.

We’re starting to hear calls for the Bank of Canada to stop raising interest rates. It’s hard to tell how much of this comes from homeowners and how much is coming from the real estate industry. I have some sympathy for homeowners who really didn’t understand how much their mortgage payments would increase as interest rates rise, but not enough to support bailing out homeowners or keeping interest rates artificially low.

As for real estate agents, there are simply too many of them. The size of this industry is unsustainable. It’s never easy to be pushed out of your job, but that’s what will happen.

Conclusion

A common human failing is to see past events as inevitable; we call this hindsight bias. To make sure I’m not guilty of this myself, I went through some past posts I wrote. A common theme was that interest rates could rise at any time, and we need to protect ourselves. I certainly didn’t know when they would rise, but the need to protect yourself and your family from interest rates returning to normal levels was obvious. Owners of long-term bonds have paid the price, and the pain is just starting for mortgagors. This mess is the inevitable masquerading as the unexpected.

Friday, October 7, 2022

Short Takes: Is CPP a Tax?, Credit Card Surcharges, and more

A prominent politician recently referred to CPP premiums as a tax. This sparked a debate about this question. Personally, I find CPP premiums look a little like a tax, but mostly not. I once looked into how much of your CPP contributions are really a tax, but this was not intended to be like the current semantic discussion. I don’t think this debate about whether CPP premiums are a tax is very important, but the answer a person argues for can tell you something about what they think about more important questions. Should we scrap CPP? No. Should we be allowed to opt out of CPP? No. Can Canadians do better investing their savings on their own? No. Can most of the people who claim to be able to invest better on their own actually do better? No. Do most of the people who claim to be able to invest better on their own even know their past investment returns? No. Should we reduce CPP premiums to reduce payroll taxes for businesses? No. How about just a temporary reduction? No. Is CPP at risk of running out of money? No. Should we seek to control the rising costs of running CPP? Yes. That list of questions and answers should make just about everyone unhappy.

Pete Evans reports on new rules allowing retailers to pass credit card fees on to customers as a surcharge. Judging by comments online, customers are not happy about this prospect. I’d prefer to see this done as a discount for paying cash, but that would force retailers to advertise slightly higher prices. One thing the new law should have if it doesn’t already is that there should be some way to pay the advertised price. If a business offers no meaningful way to pay without using a credit card, it shouldn’t be allowed to add a credit card surcharge.

Ipsos has a garbage survey indicating that 53% of Canadians are $200 or less from insolvency. It must be hard work to find a way to ask the question to get people to say that they are nearly insolvent. Normally, I avoid giving oxygen to such nonsense, but this kind of survey comes up again and again. There must be good money in pumping out material for clickbait headlines. This just distracts from serious discussions about people with severe financial problems.

Robb Engen at Boomer and Echo tries to reassure investors who are ready to sell off their stocks. It’s hard to convince a scared person that they have no idea what the near future will look like.