So Stocks are Overvalued – Then What?

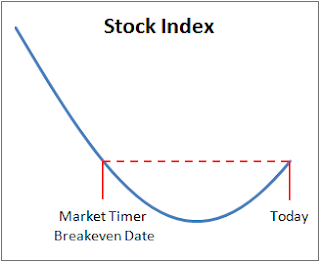

Much virtual ink is going into articles on whether stock markets are currently overvalued. Let’s suppose you know for certain that they are 25% overvalued. What should you do? The natural answer is to sell all stocks. If we knew the markets were going to have a sudden correction soon to erase the 25% overvaluation, the correct next move would be to sell all stocks and short the markets. Of course, we can’t know this. What if stock markets correct slowly over the next two decades? Suppose that the companies making up the world’s stock markets have business performance that outperforms inflation by 5% per year for the next 20 years. Suppose further that stock prices beat inflation by around 4% per year over that time so that the 25% overvaluation is erased after two decades. Is selling still the right call? The answer to that question is no. If I knew for certain my stocks would beat inflation by about 4% per year for the next 20 years, I’d be thrilled to hold them. It’s ...